Five posts in the past few months and more info about my startup: Parallax!

My Beyonce moment / why I write

Probably the most intriguing title on my blog. How I related my corepower yoga instructor’s famous words to a beautiful day I had reminding me of why I do what I do.

Why taking the MBA was and is just not a fit for me. And I’m ok with that.

The Anti-Sell Hiring Interview

Hiring is mostly about selling potential employees a coveted position in a fast-growing company. Let me tell you how and why we have an interview that does the opposite of that.

My 2023 theme of the year is: Balance ambition with kindness.

If you’re looking to work at a startup, don’t do this.

A quick intro into the company I’m building: Parallax!

Asks: First — I’d appreciate if you helped out (just 30s of your time) by:

Our mission: Parallax exists to empower the growing number of global professionals (int’l, contractors, remote workers, freelancers or small businesses) manage their money & grow their finances.

Our first product: We help global professionals who has a U.S. employer or works for a talent marketplace like Upwork get paid 10x faster and cheaper than alternatives (e.g. Paypal, Payoneer, SWIFT). We issue them a U.S. bank account (so their employers can simply ACH USD), help convert their USD into USDC to then send to their own wallets.

Eventually, we’ll build other products like debit cards, interest bearing products, global on/off ramps, and more!

Insights: Our product draws from a few (surprising!) insights:

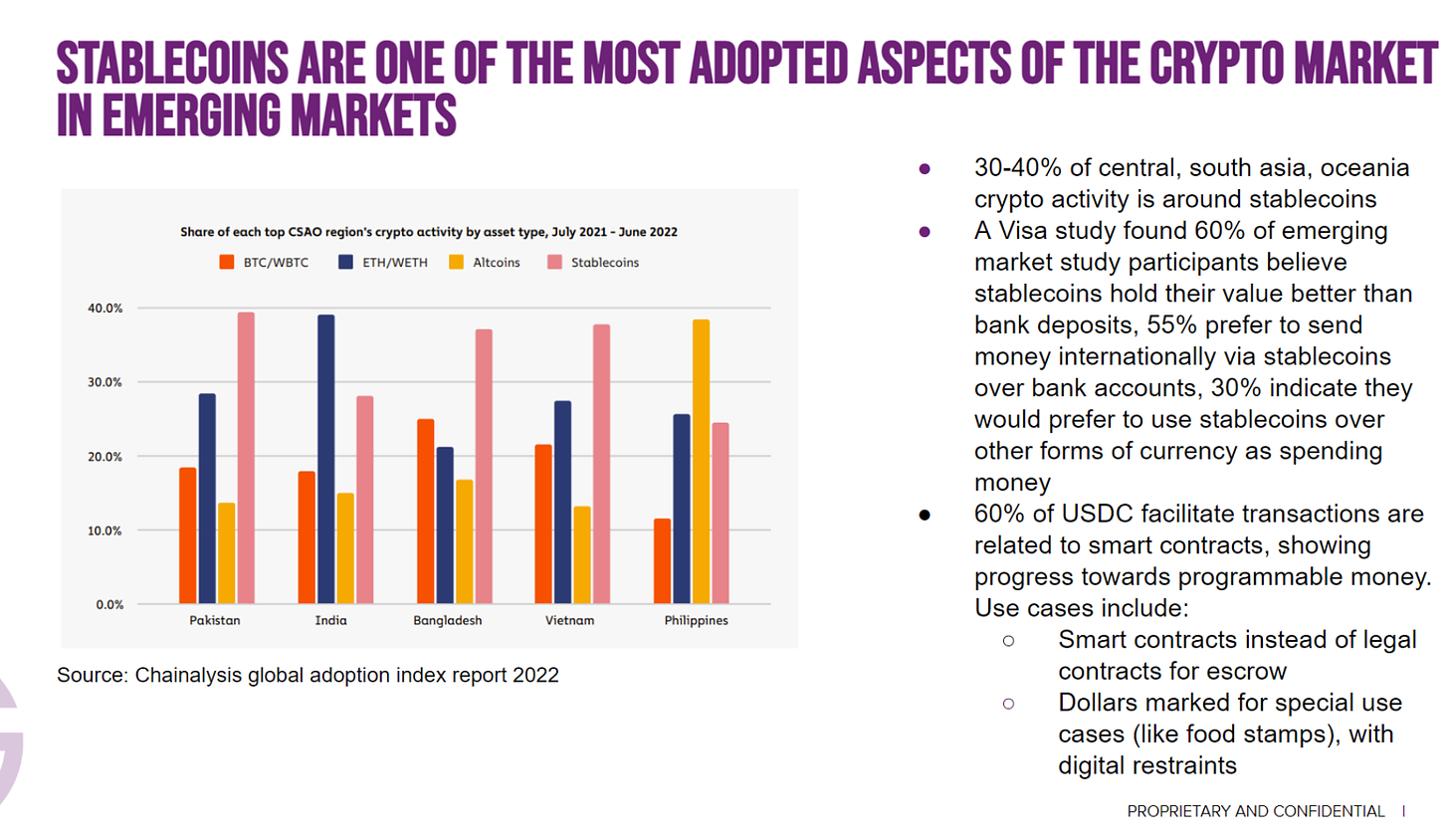

Crypto, especially stablecoins are already being used for cross-border payments.

Yes, even without Parallax, this phenomenon is already happening. The gap is that while many recipients in global and especially emerging markets want to receive stablecoins, not all employers hold stablecoins. We bridge that gap.

One of (in my opinion) best products in crypto are asset-backed stablecoins like USDC: crypto that is pegged to the dollar backed by existing reserves. Crypto does not just consist of extremely volatile assets like Bitcoin or Ethereum or NFTs.

Emerging markets are one of the biggest adopters of crypto and stablecoins. The Philippines is #2 when it comes to crypto adoption according to Chainalysis (#1 is Vietnam)!

More to come! Excited to share the journey with you all.

If you know me, you know how excited I am about impacting emerging markets like my home in the Philippines! It’s so exciting seeing that lofty goal manifest into a company I get to work on everyday. Of course, it’s been a lot of iterations, experiments, and failures to get to where we are and I’m a whole lot more along the way. But the direction and mission is clear, and I’m lucky to be in the trenches with an awesome team.

I’m learning so much, especially lessons on the intersections of fintech and crypto (which is a whole lot of compliance!)… on top of all the learnings about how to build a company. If there are particular things you’d be intrigued in learning more about as suggestions for my blog posts, feel free to share!

Still so much work to do! For now, hope you learned a ‘lil something through this post. Feel free to reach out if you’ve got questions, are curious to learn more or, most excitingly, want to become a beta tester!!